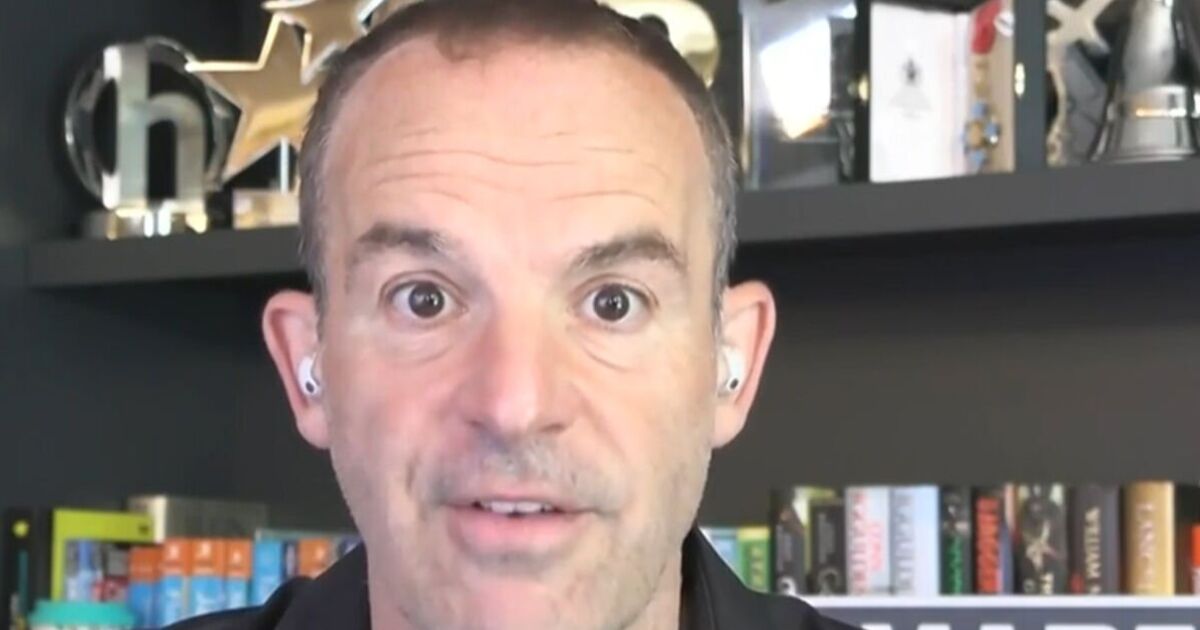

Martin Lewis clarified a “myth” about a state pension rule today, addressing misconceptions about National Insurance contributions.

Taking to ITV’s This Morning show earlier, the Money Saving Expert founder was asked by a 60-year-old viewer if they need to continue paying National Insurance (NI) if they already have 35 years of contributions.

This is the figure that’s typically recommended to have to be entitled to claim the full state pension. People accumulate NI years through active employment or by receiving NI credits, which are granted during periods of unemployment, illness, or while fulfilling parental or caregiving responsibilities.

Looking exasperated, the financial guru said: “Let’s get rid of this 35-year rule myth. I often talk, when I do my programmes, about National Insurance years for the state pension.

“I say you need 35 years-ish to qualify for the state pension. In fact, the last time I did my graphics, I got a massive ‘Ish’ put up there.

“You do not need 35 years, you need 35 years…ish. For some people, it’s 43 years, so I can’t answer that question.”

Guiding people on what they “can” do, Mr Lewis urged: “You can go on to http://GOV.UK and look at your state pension forecast. You can look at whether you are on track to have the full state pension.

“What that means is, it may say, ‘Yes, if you were to continue to pay National Insurance for the rest of your life, you would get the full state pension’. So, in your situation, you need to look at whether you already have enough years, or whether it is assuming you will keep getting National Insurance until you get to the state pension retirement age.

“If it is assuming you will keep getting state pension National Insurance, then you will need to make voluntary contributions, which you can do on a weekly basis. If you’re self-employed, for example, you can make those voluntary contributions.”

He added: “So I can’t tell you whether you need it or not. But I can tell you how to check. And if you get confused, then the Future Pension Centre, which is a Government helpline, a state helpline, should be able to talk you through it.

“But please, let’s just disabuse the notion that all you need is 35 years. It depends on a lot of variables.

“You cannot simply say I’ve got 35 years, therefore I’m going to get the full state pension.”

Britons can access the Check your State Pension forecast via http://GOV.UK or via the HMRC app.

Following a deadline extension, those eligible have until April 5, 2025, to pay voluntary contributions to make up gaps in their NI record between April 6, 2006, and April 5, 2018.

From April 6, 2025, people will only be able to pay voluntary contributions for the previous six tax years, in line with normal time limits.