NEWYou can now listen to Fox News articles!

Donnie Wahlberg is already thinking about his post-Thanksgiving meal.

In an interview with Fox News Digital, the 56-year-old star of the “Blue Bloods” spinoff, “Boston Blue,” shared his favorite part of the holiday and what he looks forward to every year.

“I would say for Thanksgiving, for me, the best part was just leftovers,” he said. “Taking whatever was left of the turkey and trying to make a sandwich out of it a few hours after the original meal was digested. And Jenny and I do that. We literally can’t wait for leftovers. We wake up Thanksgiving morning, she starts cooking because she loves to do Thanksgiving. And we are literally like, I can’t wait to be making a leftover sandwich at midnight.”

With their busy schedules, it’s not always possible to get the whole family together for the holidays. He and wife, Jenny McCarthy, live in Illinois, “so we try to focus on our kids and being able to have the holidays with them,” and when it comes to his siblings, he says they’ll do it if it works out.

Mark Wahlberg can’t wait until the next day to eat his Thanksgiving leftovers. (Matt Winkelmeyer/Getty Images for iHeartRadio)

Here is what other celebrities love about Thanksgiving.

JENNY MCCARTHY, DONNIE WAHLBERG DISH ON THEIR THANKSGIVING TRADITIONS AND LIFE IN THE LIMELIGHT

Candace Cameron Bure

Candace Cameron Bure is thankful for her family this Thanksgiving. (Alberto E. Rodriguez/Getty Images)

“Fuller House” star Candace Cameron Bure has a lot to be thankful for this holiday season.

When speaking with Fox News Digital, the actress joked her answer to what she’s grateful for “is probably so boring,” and that she “say[s] the same thing every year.”

“I just, there’s nothing more important to me than my family and my children,” she said. “And as my family is expanding, because I have two children that are married now, I still, still another one, you know, that one to go in that sense, but the expanding family means so much and you just cherish the moments the older that you get. And so I’m happy to be home with my family this Thanksgiving.”

Bure’s daughter Natasha married actor Bradley Perry in September, while her oldest son, Lev, got married in January 2024. She shared another son, Maxim, with her husband of 29 years, Valeri.

WATCH: CANDACE CAMERON BURE SHARES WHAT SHE IS GRATEFUL FOR THIS THANKSGIVING

Martina McBride

Martina McBride is thankful for her health. (Photo by Jason Kempin/Getty Images for CMT)

Country superstar, Martina McBride, spoke with Fox News Digital about all things Thanksgiving.

When it comes to food, the “This One’s for the Girls” singer said her favorite dish has to be mashed potatoes and gravy, explaining, “We don’t have mashed potatoes very often, so that’s kind of a special thing.”

She also recalled her craziest Thanksgiving experience – the year she performed during the Macy’s Thanksgiving Day Parade in New York in the morning, “then flew home to Nashville that day” where she “cooked a whole Thanksgiving dinner.” After dinner, she then got on her bus to start her tour, saying “I don’t know how I pulled it off.”

“Family comes at the top of the list, but besides that I’m grateful for my health,” she shared. “I think as we get older that becomes on the top of your mind. I’m grateful for my health and my family’s health and well-being.”

WHAT MARTINA MCBRIDE MAKES FOR AN EASY THANKSGIVING DESSERT

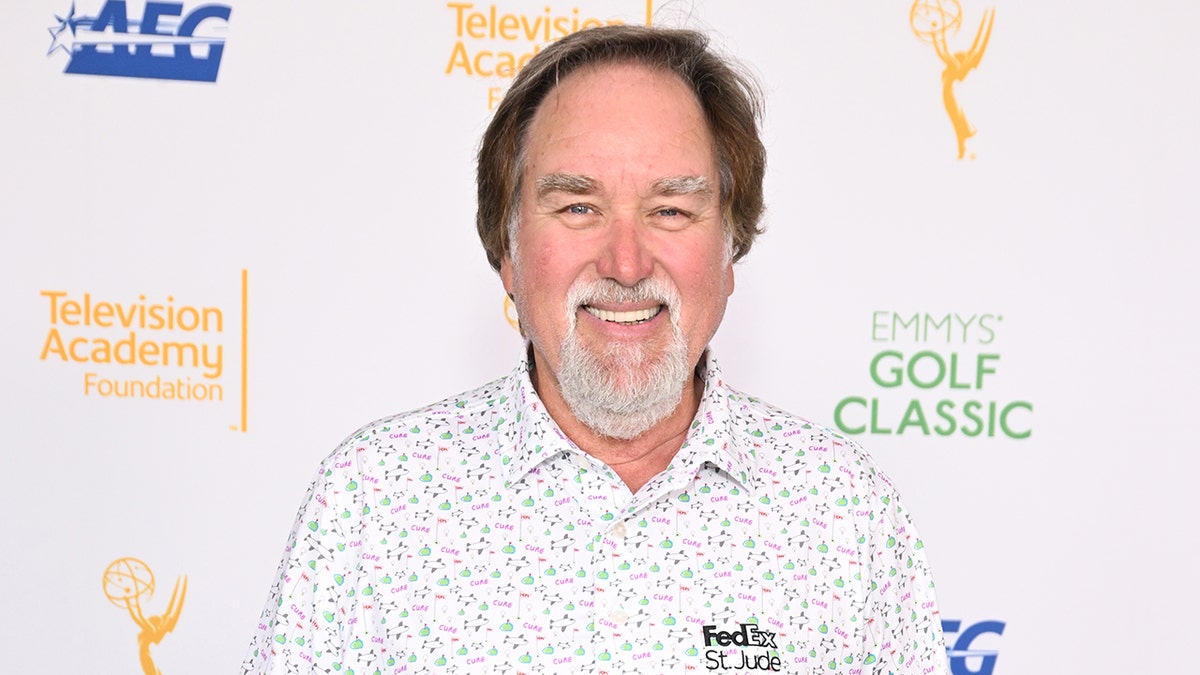

Richard Karn

Richard Karn has kept the same Thanksgiving traditions for 40 years. (Michael Tullberg/Getty Images)

“Home Improvement’s” Richard Karn told Fox News Digital the holiday “is all about the tradition” his family has created, adding that his family’s “traditions have stayed pretty consistent for 40 years.”

“We have the turkey, we have the mashed potatoes, we have green beans with slivered almonds. We have something from my family, my grandma Ruth used to make shrimp salad, so I make a shrimp salad, very simple shrimp salad with all the other things.”

Karn also likes to keep the Thanksgiving spirit going for an additional day, making turkey sandwiches with the leftovers. His Thanksgivings are a lot smaller these days than when he was a kid, explaining now he has about five or six guests but when he was a kid he was surrounded by his big family with 12 or 15 people around the table.

Those big family Thanksgivings and his childhood are some of the things he is thankful for this year, noting, “My mom and dad did a great job. We didn’t have a lot of money…but we got by.” He later added he is thankful for “Home Improvement” and his chemistry with Tim Allen.

Karn said he had great chemistry with Tim Allen on “Home Improvement.” (ABC Photo Archives/Disney General Entertainment Content via Getty Images)

HOLLYWOOD’S HALLOWEEN: PARIS HILTON, FORMER DISNEY STAR VICTORIA JUSTICE LEAD CELEBS IN EYE-CATCHING COSTUMES

“I rose to the occasion and did exactly what they needed me to do for the pilot, but a little bit more, because the audience, who hadn’t seen the show, was reacting to Tim and my relationship,” he said. “Even though it wasn’t really flushed out, it was all there in subtext… and how we bounced off each other…so I’m thankful for that happening.”

He added: “I’m grateful that, you know, 40 years of marriage and we still, you now, are on the same page most of the time. And my son, who keeps surprising me all the time.”

Erin Murphy

Murphy isn’t hosting Thanksgiving this year for the first time in about 30 years. (Taylor Hill/FilmMagic)

For the first time in about 30 years, “Bewitched” star Erin Murphy isn’t “doing Thanksgiving and like the whole meal myself.”

In an interview with Fox News Digital, Murphy said she is embracing the “transitions” that come with being a parent and your kids growing up, saying she’s “letting them do their thing” and take over the holiday hosting duties.

She is thankful for a lot of things this Thanksgiving, including her health and her family.

CLICK HERE TO SIGN UP FOR THE ENTERTAINMENT NEWSLETTER

“Living in a world where we can kind of recreate our lives and do what we want. So I guess I’m thankful. It sounds so simple,” she said. “I’m thankful for freedom. For being able to wake up and decide what to do that day and whether that means, ‘Oh, I’m gonna go for a walk’ or ‘I’m going to get my girlfriends and let’s go to thrift stores and look for cool clothes.’ It’s like just kind of the ability to find joy in the small things in life.”

Katherine Schwarzenegger Pratt

Katherine Schwarzenegger Pratt is thankful for her family and her health. (Getty Images)

Katherine Schwarzenegger Pratt has a lot to be thankful for this Thanksgiving.

When speaking with Fox News Digital, the mom of three said one of the things she is thankful for this year is her new book, “Kat and Brandy,” which tells a heartwarming story about the relationship between animals and humans.

“I am thankful for my health, I’m thankful for my family and I’m really thankful for this book because I think that it is something I’m really proud of,” she said.

WATCH: KATHERINE SCHWARZENEGGER IS THANKFUL FOR HER FAMILY AND ‘THE PRESENCE OF ANIMALS IN OUR LIVES’

“I am really excited about and also the messaging in the book and from the book that children will get and also adults will get is something that I feel really grateful for and really thankful for and I think because of that I’m also really thankful of the presence of animals in our lives at all,” she explained. “Phases of life because it’s such a blessing to be able to have that presence”.

LIKE WHAT YOU’RE READING? CLICK HERE FOR MORE ENTERTAINMENT NEWS

Mark Wahlberg

Mark Wahlberg is looking forward to having his kids under one roof over the holidays. (Steve Granitz/FilmMagic)

Mark Wahlberg is looking forward to having all his kids under one roof this holiday season.

The “Family Plan” actor shares four children with his wife, Rhea Durham: Ella, 22, Michael, 19, Brendan, 17, and Grace, 15.

“They all have their own interests, but the holiday season allows us the time to go on a trip together, and we stay in very small close quarters where we have to have breakfast together every day, we have our lunch together and then dinner together every day, and then they still get to kind of do their thing throughout,” he said.

WATCH: MARK WAHLBERG SAYS THE HOLIDAY SEASON ALLOWS FOR HIS KIDS TO BE UNDER ONE ROOF AGAIN

He continued: “But it’s still, it’s a small place so we all kind of, you know, we’re in each other’s company and around each other the whole time and from my wife and I, it’s the best time of the year and the kids enjoy it as well because they get to hang out with their friends and do stuff, but they’re stuck with their parents.”

CLICK HERE TO DOWNLOAD THE FOX NEWS APP

Fox News Digital’s Larry Fink, Christina Dougan Ramirez, Brie Stimson, Lauren Overhultz and Stephanie Giang contributed to this report.