NEWYou can now listen to Fox News articles!

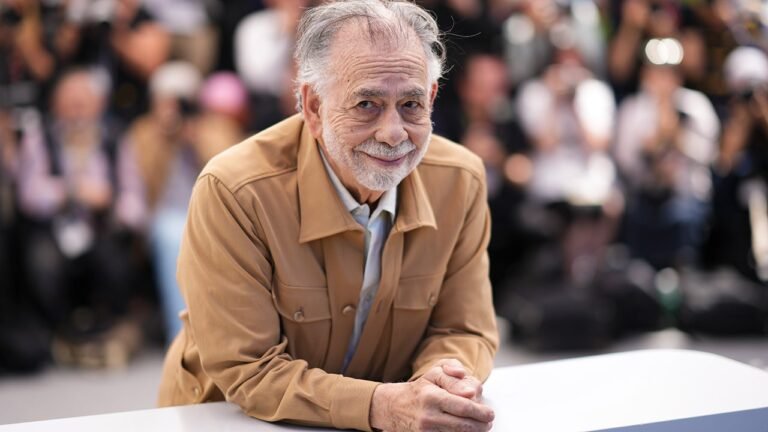

Francis Ford Coppola, director of “The Godfather,” was hospitalized in Italy last week for a non-emergency cardiac procedure.

The filmmaker, 86, sought to update a “30-year-old AFib procedure,” according to a post on his Instagram page.

AFib, or atrial fibrillation (AFib), is an “irregular and often rapid heart rhythm” that can raise the risk of blood clots, heart failure, stroke and other heart-related complications, according to the American Heart Association.

HEART ATTACK DEATHS HAVE PLUMMETED IN US, BUT NEW CARDIOVASCULAR THREATS EMERGE

After Italian media sources reported the director’s hospital visit, a representative for Coppola called it a “scheduled update procedure” and said he was “resting nicely.”

“All is well,” according to his representatives.

Francis Ford Coppola, director of “The Godfather,” was hospitalized in Italy last week for a non-emergency cardiac procedure. (Photo by Scott A Garfitt/Invision/AP)

“Da Dada (what my kids call me) is fine,” the director said on his social media, speaking for what appears to be the first time about his condition.

He continued: “Taking an opportunity while in Rome to do the update of my 30-year-old AFib procedure with its inventor, a great Italian doctor — Dr. Andrea Natale! I am well!”

YOUR HEART MAY BE OLDER THAN YOU THINK — AND THE NUMBER COULD PREDICT DISEASE RISK

Dr. Bradley Serwer, an interventional cardiologist and chief medical officer at VitalSolution, an Ingenovis Health company, spoke with Fox News Digital about the condition.

“AFib is typically not immediately life-threatening, but it can lead to complications or issues in the future,” said the cardiologist, who has not treated Coppola.

The filmmaker, 86, sought to update a “30-year-old AFib procedure,” according to a post on his Instagram page. (Getty Images)

With AFib, the normal electrical activity in the heart changes to chaotic electrical signals, according to the Maryland-based cardiologist. This causes the heart to beat quickly and get out of rhythm.

Instead of contracting normally, the upper chambers of the heart — called atria — start to quiver, causing blood clots to form.

“When these clots break free, they can travel to the brain, causing a stroke,” Serwer cautioned.

‘I’M A CARDIOLOGIST – HERE’S HOW THE SUMMER HEAT COULD DAMAGE YOUR HEART’

For many people, AFib may have no symptoms, but for some, it can cause a fast or pounding heartbeat, shortness of breath or lightheadedness.

“AFib can be challenging due to its diverse manifestations,” Serwer noted.

There are several procedural approaches to treat atrial fibrillation, according to the cardiologist.

There are multiple treatment options for AFib, which is not always life-threatening. (iStock)

The most common procedure is called an ablation, which is when a specialized cardiologist uses catheters to follow the heart’s electrical activity. The doctor then burns the sites where the AFib begins.

“This procedure has a high rate of success and complications are low, making it a highly valued option,” Serwer noted.

CLICK HERE TO GET THE FOX NEWS APP

If a patient is undergoing open-heart surgery for coronary artery disease or valvular heart disease, a surgeon can perform a “maze procedure,” which creates a “maze-like pattern of scar tissue” in the upper chambers of the heart to block irregular electrical signals, according to Mayo Clinic.

CLICK HERE TO SIGN UP FOR OUR HEALTH NEWSLETTER

There are also procedures to reduce the risk of stroke in patients who have AFib, but who may not be able to take blood thinners.

By placing a small device where blood clots form, the rate of stroke drops significantly, Serwer said.

AFib may cause a fast, pounding heartbeat, shortness of breath or lightheadedness. (iStock)

In some cases of atrial fibrillation, the condition can come and go, but other patients may experience persistent AFib, the cardiologist said.

For more Health articles, visit www.foxnews.com/health

While it’s not usually life-threatening, AFib is still considered a serious medical condition that requires proper treatment.

Serwer advised, “If you experience sudden-onset dizziness or palpitations that persist, it is imperative to seek immediate evaluation from a medical professional.”