NEWYou can now listen to Fox News articles!

As Jeffrey Epstein’s most notorious accomplice and former girlfriend is angling to have her criminal conviction dropped, a look at Ghislaine Maxwell’s life behind bars could offer clues about her motivations outside of prison.

Maxwell has reportedly rebranded herself while serving out her two-decades-long sentence for her involvement in Epstein’s sex crimes.

“I did a double take, because I recognized her face immediately from the news,” Jessica Watkins, a former Oath Keeper who was imprisoned in the same low-security Florida facility as Maxwell, told the Daily Mail. “I was like, ‘Is that who I think it is?’”

EPSTEIN ACCOMPLICE GHISLAINE MAXWELL COULD BE EYEING THREE OUTCOMES AS SHE MEETS WITH DOJ AGAIN: EXPERT

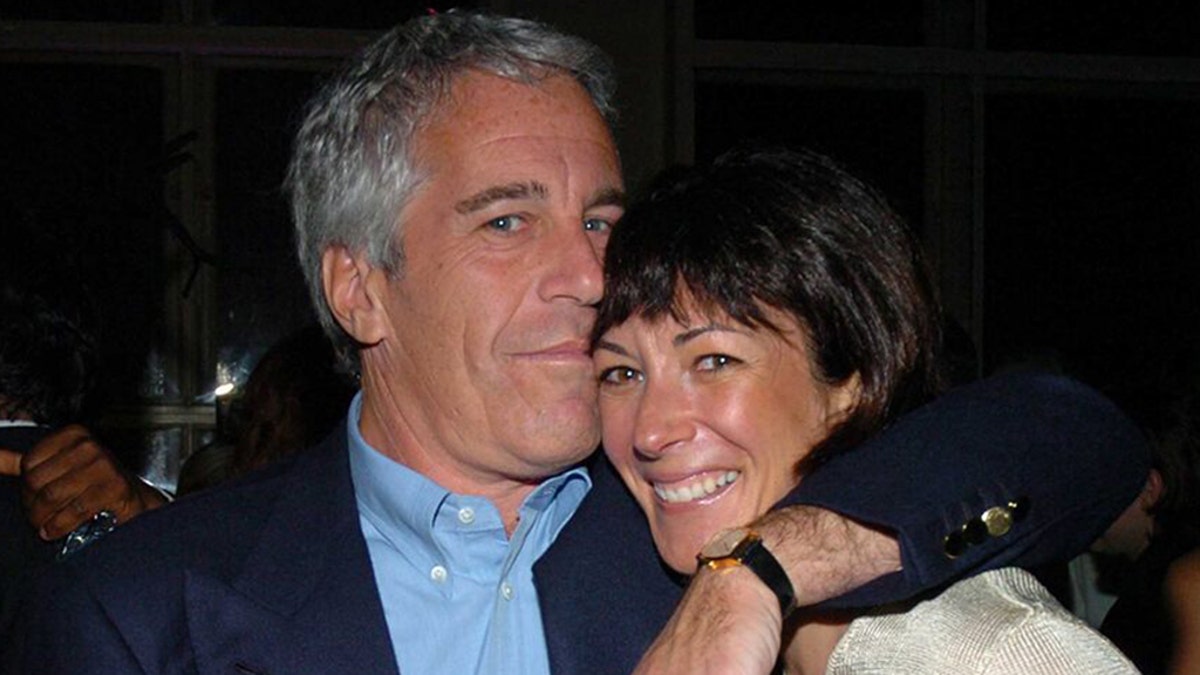

Ghislaine Maxwell procured underage victims for Jeffrey Epstein. (Patrick McMullan)

Watkins was initially sentenced to 8.5 years in prison for her involvement in the attack on the U.S. Capitol on Jan. 6. Her sentence was commuted by President Donald Trump on his first day back in office earlier this year.

“My friend who was with me was like, ‘I don’t know – who is it?’” Watkins said. “I caught her up on the situation. Started asking around and it was definitely her.”

She and Maxwell would converse regularly — often while the pair were exercising in the open-air prison yard — with Maxwell only bringing up her case on occasion, Watkins told the outlet.

TIMELINE OF JEFFREY EPSTEIN CASE

“We don’t talk about cases as inmates because people will think you’re a snitch,” Watkins explained. “It’s an unspoken rule among inmates. You don’t ask.”

However, Watkins reportedly could only recall one time when Maxwell mentioned Epstein.

“She did say that the DOJ had no interest in her until after, her exact words were until after Jeffrey, and then she paused for a second and said ‘died,’” Watkins said. “That was the only time he ever came up.”

JEFFREY EPSTEIN CASE REOPENS FOCUS ON GHISLAINE MAXWELL AS DEPUTY AG STEPS IN

WATCH: President Donald Trump explains why he kicked Jeffrey Epstein out of Mar-a-Lago

During the pair’s time together in prison, Watkins noticed Maxwell “didn’t seem unduly worried” while behind bars, adding, “She seemed very at ease, very calm and approachable.”

Her reportedly calm demeanor makes sense to former Palm Beach County State Attorney Dave Aronberg, who was elected into office six years after Epstein’s case concluded.

“The other inmates know who she is and why she’s behind bars,” Aronberg told Fox News Digital. “I’m sure a lot of the other inmates have their hands out. They want the commissary money. They want a free education from her, whatever she can provide.”

EPSTEIN’S FORMER LAWYER: GHISLAINE MAXWELL SHOULD GET IMMUNITY IN EXCHANGE FOR SECRETS

A deposition that British socialite Ghislaine Maxwell gave in 2016 relating to her dealings with the late Jeffrey Epstein is pictured in the Manhattan borough of New York City, New York, U.S., October 22, 2020. (REUTERS/Carlo Allegri)

While in prison, Maxwell offers legal advice and classes to her fellow inmates, often helping individuals access the necessary forms related to their case and working in the law library, according to Watkins.

“She was very concerned about peoples’ medical well-being,” Watkins said. “So she did have that kind side to her.”

She also reportedly focused her free time on reading books, working on her own case or working out — foregoing the prison’s television privileges.

DOJ REJECTS GHISLAINE MAXWELL’S APPEAL IN SCOTUS RESPONSE

However, her work behind bars could indicate an attempt to win over her fellow inmates’ favor while leveraging her educational background, according to Aronberg.

“She had status when she was not behind bars,” Aronberg said. “She took that into the prison facility with her, and she is using that.”

Watkins also described how she and Maxwell found a friendship in their choice to not partake in drug use while locked up.

“We avoided most of the inmates [because] they were high all the time, and we didn’t want to be around that,” Watkins told The Daily Mail. “[Maxwell] would gravitate towards people who were also sober.”

Watkins’ attorney did not immediately respond to Fox News Digital’s request for comment.

JEFFREY EPSTEIN THROWN OUT OF MAR-A-LAGO FOR HIRING THE HELP: TRUMP

In this courtroom sketch, Ghislaine Maxwell confers with her defense attorney Jeffrey Pagliuca, right, before testimony begins in her sex-abuse trial, in New York, Wednesday, Dec. 8, 2021. (AP Photo/Elizabeth Williams)

Maxwell’s reported decision to not use recreational drugs while in prison could be a larger move to remain out of trouble while she makes a bid for freedom, according to Aronberg.

“An inmate’s good behavior won’t impact their ability to get a new trial,” Aronberg told Fox News Digital. “But it does impact their ability to get clemency.”

Aronberg pointed to Maxwell’s two days of meetings with Deputy Attorney General Todd Blanche last week, as President Donald Trump commented on his ability to hand the convicted criminal a pardon.

TRUMP DROPS EPSTEIN-LINKED NAMES THAT MEDIA ‘OUGHT TO BE SPEAKING ABOUT’ AMID FILES FIRESTORM

“This is a convicted sex trafficker,” Aronberg said. “This is someone who committed sexual assault on minors. This is someone who is indicted for perjury. And yet, she got a private audience with the No. 2 person at the DOJ. Had she been less of a model prisoner behind bars, perhaps the administration wouldn’t be rushing to meet with her and believe her in what she’s saying.”

Blanche spent nearly two days at a federal courthouse in Tallahassee interviewing Maxwell, who answered questions “about 100 different people,” according to her attorney.

“She never invoked a privilege,” David Oscar Markus told reporters on Thursday. “She never refused to answer a question, so we’re very proud of her.”

EPSTEIN ACCOMPLICE GHISLAINE MAXWELL HOPES FOR TRUMP PARDON AFTER DOJ MEETING, ATTORNEY SAYS

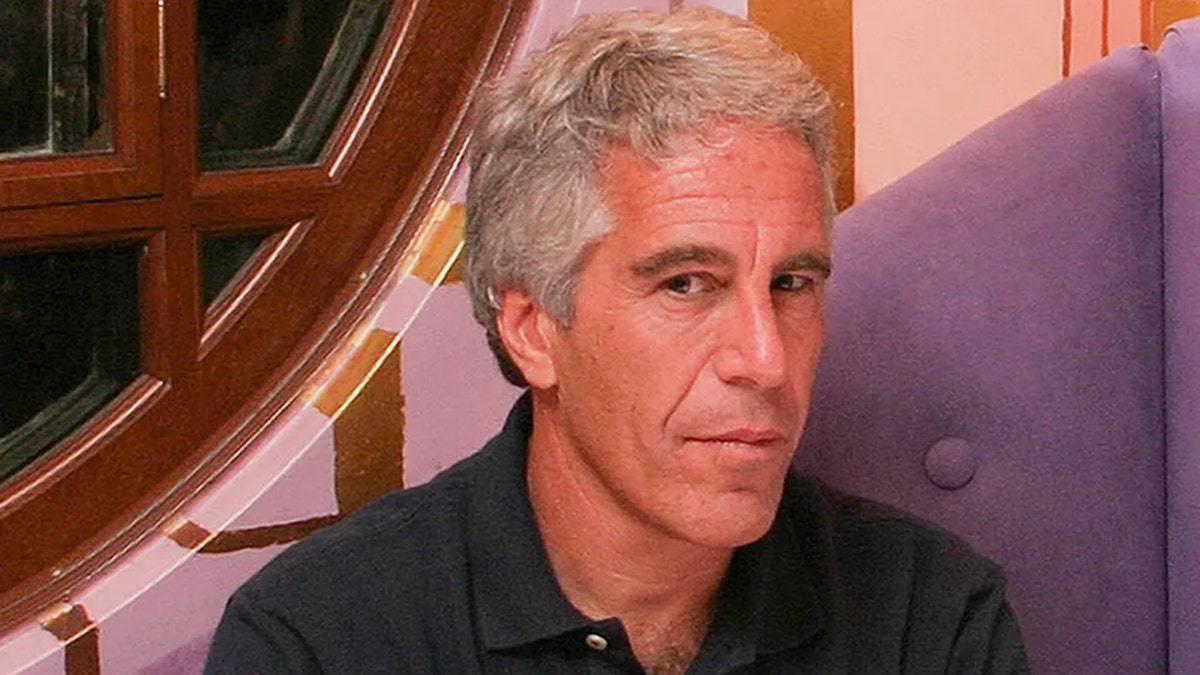

Jeffrey Epstein was facing federal sex trafficking charges stemming from years of abuse of minors. (Rick Friedman/Corbis)

The talks come as a House committee subpoenaed Maxwell to testify in a congressional deposition over her knowledge of the scope of Epstein’s crimes, while lawmakers continue to demand the DOJ hands over files related to the case.

However, Aronberg urges caution from federal prosecutors when taking Maxwell’s words at face-value.

“If you’re a model prisoner behind bars, then prosecutors are more likely to believe that you really are trying to do the right thing, you’re reformed and you are telling the truth this time around,” Aronberg said. “But it’s hard to ignore the fact that she is a liar.”

On Monday, Maxwell’s legal team submitted a brief asking the U.S. Supreme Court to hear her appeal of her federal sex trafficking conviction, citing the government’s “obligation to honor” an agreement struck by Epstein that should have shielded Maxwell from any criminal charges.

JEFFREY EPSTEIN ACCOMPLICE GHISLAINE MAXWELL TO SEE HOW FEDS MEETING PLAYS OUT AMID SUBPOENA: BROTHER

Federal prosecutors have argued the deal only applied in Florida, ultimately ruling out Maxwell’s case in New York.

“No one is above the law — not even the Southern District of New York,” Markus said in a statement. “Our government made a deal, and it must honor it. The United States cannot promise immunity with one hand in Florida and prosecute with the other in New York.”

Markus went on to appeal to Trump, who has previously said he has the power to pardon Maxwell but has “not thought about” doing so.

“President Trump built his legacy in part on the power of a deal—and surely he would agree that when the United States gives its word, it must stand by it,” Markus said. “We are appealing not only to the Supreme Court but to the President himself to recognize how profoundly unjust it is to scapegoat Ghislaine Maxwell for Epstein’s crimes, especially when the government promised she would not be prosecuted.”

CLICK HERE TO GET THE FOX NEWS APP

The DOJ did not immediately respond to Fox News Digital’s request for comment.

Maxwell is currently serving a 20-year sentence for her role in Epstein’s scheme to sexually abuse numerous young girls. She is anticipated to testify under oath on Aug. 11 at or near the federal prison she is currently serving her sentence in.

“Jeffrey Epstein could not do what he did without Ghislaine Maxwell,” Aronberg said. “She’s no victim. She is the devil’s accomplice.”