NEWYou can now listen to Fox News articles!

The Minnesota man accused of murdering a lawmaker and her husband, and leaving another lawmaker and his wife injured while dressed as a police officer possessed an extensive security background, raising questions about his access to weapons and law enforcement uniforms in what authorities are calling a “targeted” attack.

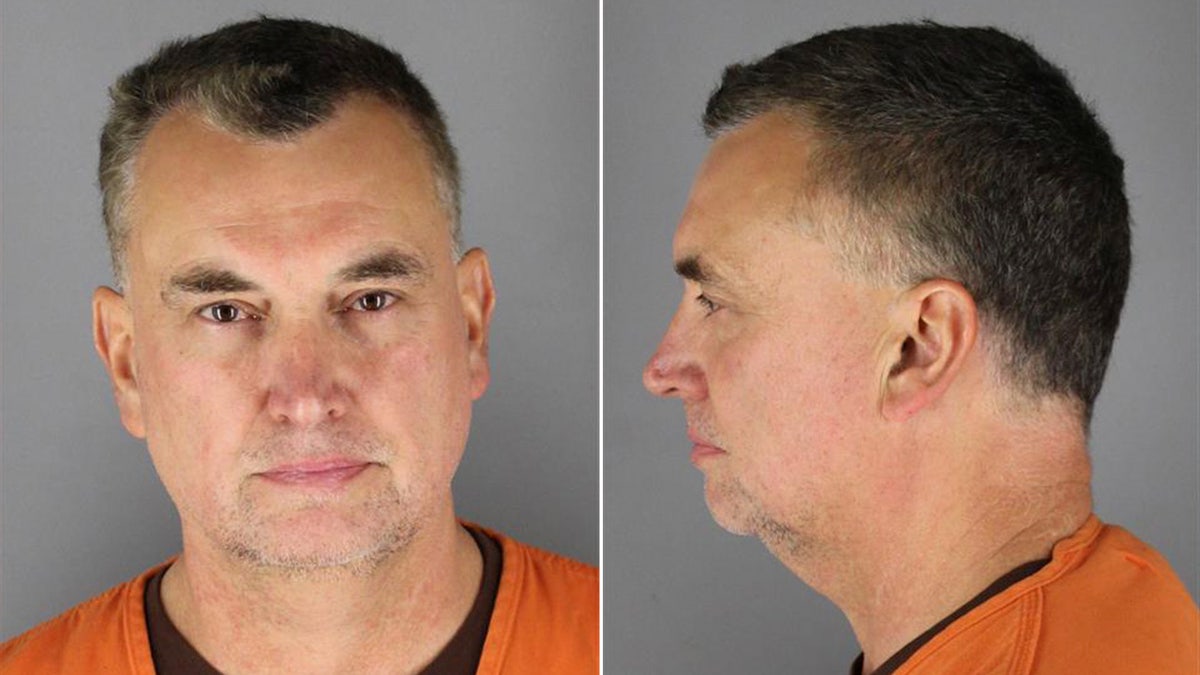

Vance Luther Boelter, 57, is accused of killing former Minnesota House Speaker Melissa Hortman and her husband, Mark, and shooting state Sen. John Hoffman and his wife, Yvette, in separate incidents early Saturday morning.

Boelter allegedly arrived at both lawmakers’ homes dressed in a law enforcement-like uniform and driving a black SUV with flashing emergency lights and a license plate that read “police.”

MINNESOTA SHOOTING SUSPECT VANCE BOELTER TO FACE FEDERAL CHARGES IN LAWMAKER ATTACKS

A mugshot of Minnesota lawmaker shooting suspect Vance Boelter in custody at Hennepin County Jail. (Hennepin County Jail)

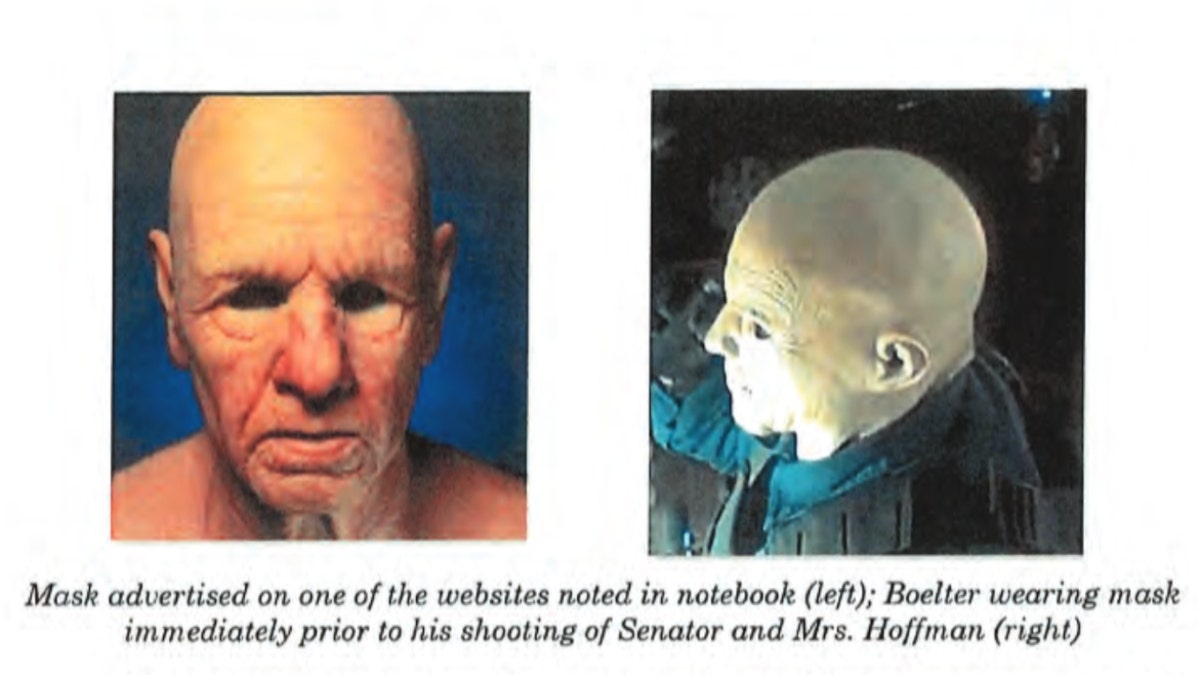

“Boelter wore a black tactical vest and body armor. He carried a flashlight and a Beretta 9 mm handgun,” acting U.S. Attorney Joseph H. Thompson said. “He also wore a hyper-realistic silicon mask. Senator Hoffman had a security camera. I’ve seen the footage from that camera, and it is chilling. Boelter knocked on Senator Hoffman’s front door, and repeatedly shouted, ‘This is police. Open the door.'”

When Hoffman and his wife approached, Boelter allegedly shined a flashlight into their faces before shooting them and fleeing the scene. The couple’s daughter then called 911, according to Thompson.

“Let’s say I’m an active cop,” Bill Stanton, a former NYPD officer and author of “Prepared Not Scared,” told Fox News Digital. “And many of these states have different uniforms county to county. So if I roll up and I see a car with flashing lights, it may be a county I didn’t know. My initial knee-jerk reaction, as a cop responding, is this law enforcement agency that I’m not aware of.”

MINNESOTA LAWMAKER SHOOTING SUSPECT HAD CACHE OF WEAPONS, HIT LIST IN VEHICLE, COURT DOCUMENTS SHOW

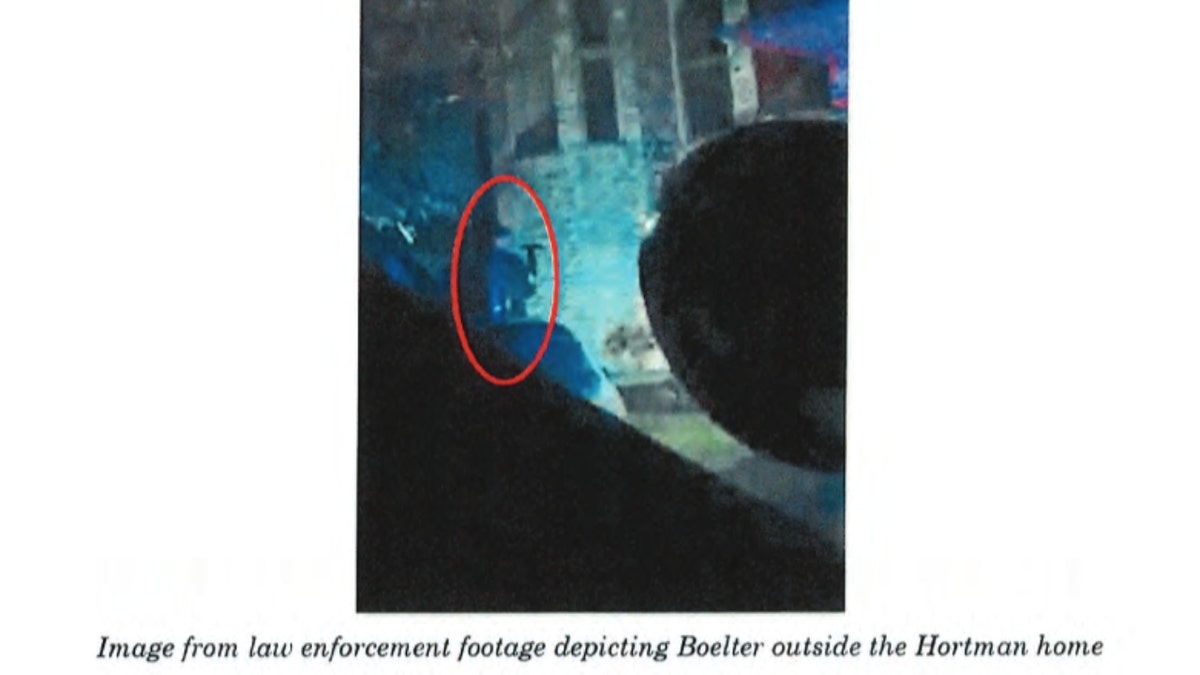

A surveillance photo released by authorities shows a masked suspect wearing police-like tactical gear and carrying a flashlight as officials raced to find Vance Boelter, the suspected gunman in the shooting of two Democratic lawmakers in Minnesota on Saturday, June 14, 2025. (Minnesota Department of Public Safety)

After leaving Hoffman’s home, Boelter then allegedly drove to Hortman’s residence and knocked on the lawmaker’s door wearing a silicone mask and law enforcement uniform. At the same time, local police were en route to Hoffman’s home to conduct a wellness check.

“The New Hope police officer pulled up next to Boelter, rolled down her window and attempted to speak with him,” Thompson said. “Boelter did not respond. The New Hope police officer proceeded to the state senator’s home, and she waited for law enforcement to arrive. By the time they did, Boelter had left the scene.”

Boelter allegedly fled on foot, prompting a two-day-long manhunt that ended with him being taken into custody without incident.

Fox News Digital was unable to immediately identify an attorney for Boelter.

SUSPECTED MINNESOTA LAWMAKER ASSASSIN VANCE BOELTER CAPTURED

Former Minnesota House Speaker Melissa Hortman and Sen. John Hoffman were targeted in a shooting that left the former dead and the latter seriously injured. (AP Images)

“My first instinct wouldn’t be [that] this is a fake cop looking to kill someone,” Stanton said. “The reason being is it’s so rare, because it’s such a heavy charge – impersonating a police officer. That’s a major felony in many, many states.”

Boelter has an extensive history of private security training and was working as director of Praetorian Guard Security Services, a company created by his wife, and CEO of Red Lion Group, according to his LinkedIn page.

“I have been doing projects in the Democratic Republic of Congo in Central Africa for the last three years with the Red Lion Group,” Boelter wrote on his LinkedIn page last month, noting that he is currently open to work.

MINNESOTA OFFICIALS FIND CAR, HAT BELONGING TO ASSASSIN SUSPECT VANCE BOELTER ON HIGHWAY IN ‘FLUID’ SEARCH

Vance Boelter allegedly wore a “hyper-realistic” silicon mask while targeting victims on Saturday. (DOJ)

Boelter’s ties to private security and prior law enforcement training may have provided him with the tools needed to carry out the alleged crimes, Stanton said.

“It was a long decline into insanity with this guy,” Stanton told Fox News Digital. “An obsession – he started targeting; My guess is he’s been doing this for years. And then finally, there was some trigger event that made him activate.”

In addition to his experience in security, Boelter has reportedly received training by members of the U.S. military and private firms, with the Praetorian Guard Security’s website depicting photos of tactical gear and other police-style uniforms.

WHO IS VANCE LUTHER BOELTER? SUSPECT IN MINNESOTA LAWMAKER KILLINGS IDENTIFIED

“Boelter wore a black tactical vest and body armor. He carried a flashlight and a Beretta 9 mm handgun,” Thompson said. He also wore a hyper-realistic silicon mask. Senator Hoffman had a security camera. I’ve seen the footage from that camera, and it is chilling. Boelter knocked on Senator Hoffman’s front door, and repeatedly shouted, ‘This is police. Open the door.'” (DOJ)

However, Stanton pointed to the improbability of an individual going to the lengths of impersonating a police officer to commit a crime, suggesting Boelter allegedly did so because of his high-profile targets.

“The odds of someone perpetuating themselves as a false cop are so rare [that] the odds are much greater that you’re going to get straight up mugged, robbed or burglarized,” Stanton said, adding, “The fact that this was politically motivated and someone went to such obsessive means to achieve their end, that’s why this isn’t an everyday occurrence.”

CLICK HERE TO GET THE FOX NEWS APP

While the odds of being approached by a fake officer are lower than being victimized by other crimes, Stanton stresses that there are ways to stay safe if an individual appears suspicious, such as calling the police to confirm an officer’s identity before engaging or driving to a police station while being pulled over.

“We see videos of thugs trying to kick in the door with a mask or a hoodie on,” Stanton said. “That’s what’s going to happen a lot sooner than someone identifying themselves as a cop. So be prepared, not scared, and have your situational awareness of security.”

Boelter is charged with two counts of stalking, two counts of murder and two counts of firearm-related crimes in federal court. He is also facing second-degree murder charges on the state level.